F1 Wants to Be America’s Next Sports Star -Will Anyone Pay?

From Free to $180M: A Big Ask in a Shaky Media Market

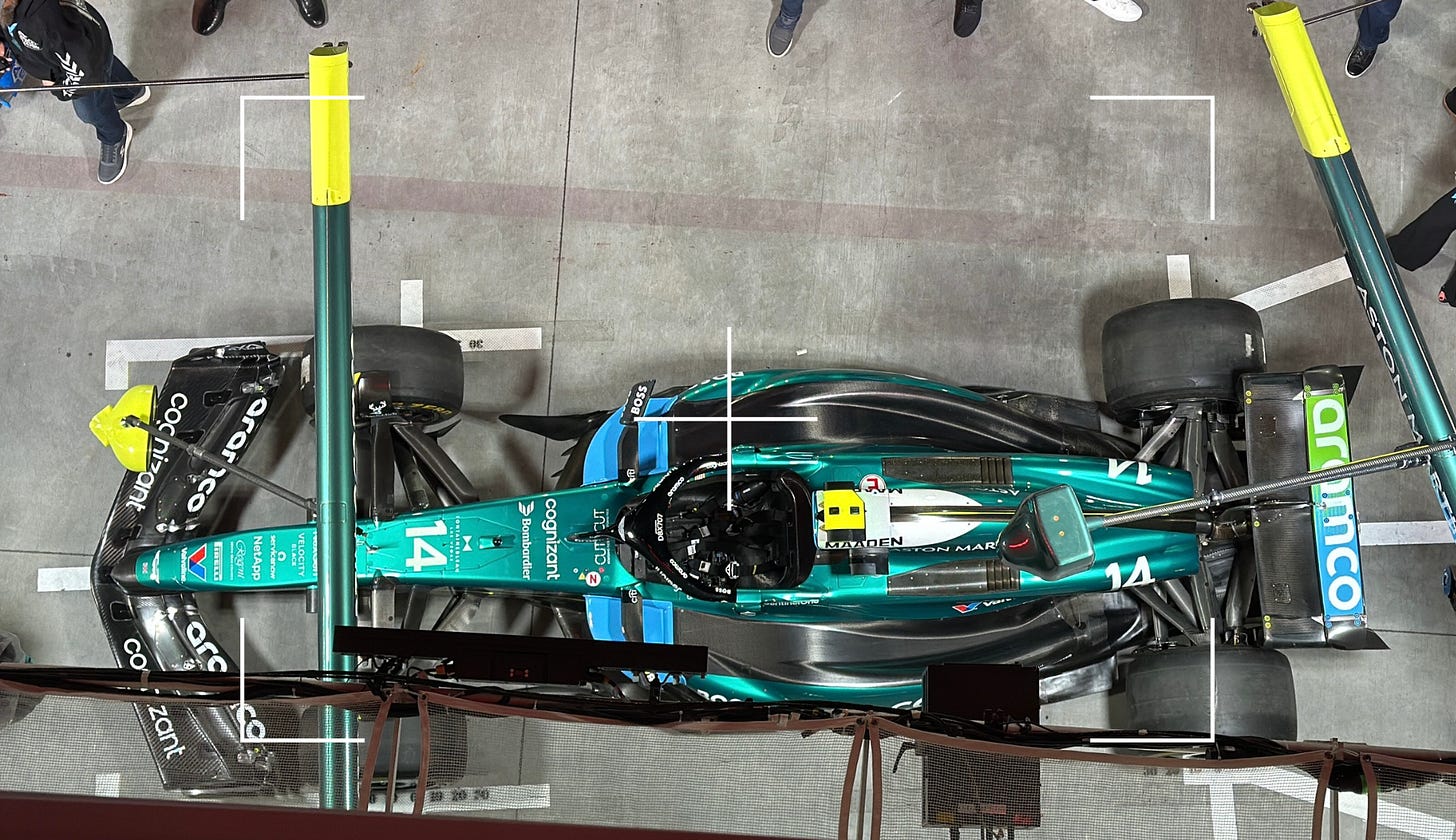

Thank you for being here. You are receiving this email because you subscribed to Idée Fixe, the newsletter for curious minds. I’m Toni Cowan-Brown, a tech and F1 commentator. I’ve spent the past five years on the floor of way too many F1, FE, and WEC team garages, learning about the business, politics, and tech of motorsports. I hope you’ll stick around.

⏳ Reading time: 15 minutes

F1 Seeking $180 M for Its Broadcasting Rights

Formula 1 is entering what could be a high-stakes negotiation over its U.S. TV broadcasting rights, reportedly asking for an eye-popping $160–$180 million per year starting in 2026 - which is both way too high and probably not high enough. This would be roughly double what Disney-owned ESPN currently pays to show F1 races in the U.S. The sport’s American fanbase has grown substantially in recent years - turbocharged by Netflix’s hit docuseries Drive to Survive, but not only. And yet, media companies are balking at F1’s hefty price tag.

F1 has and will continue to face challenges converting its recent hype into sustained American viewership, especially given time-zone hurdles, and we should also consider how shifting consumer habits (cord-cutting, multi-screen viewing, growing focus on highlights and streaming fatigue) might influence where F1’s races end up.

From Free to $90 M: A Quick History of F1’s U.S. Media Rights

Not long ago, Formula 1 struggled to find an American TV foothold. ESPN initially picked up F1’s U.S. broadcast rights for free in 2018 after the previous rights-holder (NBC Sports) walked away. This zero-fee arrangement was almost unheard of for a global sport, underscoring how little interest or leverage F1 had in the U.S. market at the time. Liberty Media, which acquired F1 in 2017, prioritised growing the American audience and was willing to sacrifice short-term TV revenue for broader exposure.

ESPN’s free deal quickly proved fruitful as U.S. viewership started to climb, thanks in part to the Netflix effect. By 2020, with new fans flocking to the sport, ESPN agreed to pay a token fee (around $5 million per year from 2020 through 2022) for the rights - a symbolic step up from free, but still a bargain. The real leap came in the next contract: in late 2022, after a surge in F1’s U.S. popularity, ESPN renewed the rights through 2025 at an average annual value reportedly between $75–90 million. This current deal (2023–2025) represented a more than tenfold increase in rights fees, reflecting F1’s newfound cachet in the States.

The growth in audience behind that big jump is real, though it has started to plateau, which was inevitable to anyone paying close attention to how F1 was going about fan growth and acquisition. In 2018, live F1 races on U.S. TV averaged only a few hundred thousand viewers; by 2023–24, that average had roughly doubled to around 1.1 million viewers per race. While 1+ million per event is a solid number for motorsports on cable, it’s still modest next to mainstream American sports. ESPN executives have noted that F1’s viewership gains have become “a slower burn” recently, with the 2024 season averaging about 1.12 million viewers, essentially flat versus 2023. In other words, the initial rapid growth has leveled off, even as F1 remains a hot pop-culture commodity. Basically, F1 is still a very niche sport.

Anecdotally, the same week last year when F1’s lawyers decided to send cease and desist letters to many of your favourite F1 creators, an agency working for F1 approached myself and others to ask for our help in being part of a paid campaign to help convert fans into paying F1TV subscribers because this was not happening organically.

Yet for ESPN, F1 has offered value beyond pure ratings. The network has aired F1 races commercial-free using Sky Sports’ feed, earning goodwill from fans, and capitalized on the sport’s ‘cool factor.’ “F1 has just become cool,” said one ESPN programming executive, emphasizing that being associated with Formula 1 delivers intangible benefits, attracting younger audiences and prestige advertisers that ESPN covets. This halo effect helped justify ESPN’s current ~$75–90 M outlay, which the network sees as an investment in a long-term play. As ESPN’s VP of programming, Tim Bunnell explained, “the ratings are one thing, but… just the cachet of being associated with Formula 1, it pays us back in droves”.

ESPN’s Reluctance and New Suitors Entering the Race

Now, however, Liberty Media is testing how far that cachet can carry them. With the 2023–25 contract winding down, F1 is shopping its next U.S. rights package for 2026 and beyond at a jaw-dropping $150–180 million per year.

ESPN had an exclusive window late last year to negotiate an extension, but walked away without a deal. The Disney-owned network, facing budget pressures and a rapidly evolving media landscape, has made it clear it won’t overpay to keep F1 at any cost. ESPN is “not interested in entering a bidding war” for the rights and is prepared to let F1 go if the price doesn’t make sense. As one report put it, ESPN would need confidence that F1 could drive significant subscriptions to a future ESPN direct-to-consumer service to justify a higher fee. Without that, the network has many other priorities (from the NFL to college football) and limited budget room, so paying nearly double for F1 is hard to swallow.

ESPN’s hesitation has thrown the competition wide open. Who might swoop in to grab F1’s U.S. rights? Thus far, the list of suitors reads like a who’s who of media and tech, but each with caveats:

NBC: The former broadcaster of F1 (2013–2017) is reportedly interested in bringing the series back “home.” NBC has a robust sports portfolio (NFL, Olympics, NASCAR, etc.) and could slot F1 races on its broadcast network or Peacock streaming platform. However, NBC also remembers why it walked away in 2017 (low viewership then), and may be unwilling to match F1’s high asking price. NASCAR remains NBC’s flagship motorsport property; adding F1 at a steep cost might only be viable if the fee comes down or if NBC can package F1 in a broader strategy for Peacock.

Netflix: The wildcard. Netflix’s F1 Drive to Survive series arguably lit the fuse (the spark, not the fuel as I’ve said many times before) on America’s F1 boom, so it would be poetic for Netflix to nab the live rights. There are signs Netflix has at least evaluated a bid for F1, and the synergy is obvious: exclusive live races on the same platform as the hit docuseries. But Netflix has never carried live sports at scale and cadence (aside from a few one-off exhibitions and events) and has been cautious about the costly, low-margin world of sports rights. Another concern: Ampere Analysis data shows that 75% of self-identified F1 fans in the U.S. are already Netflix subscribers. That means Netflix might not see a huge subscriber bump from adding F1 - most of the interested audience is already on the service. Without the lure of new subscriber growth, justifying a ~$150M+ annual rights check is tough for Netflix, unless they see other strategic value.

Apple: The tech giant has made bold forays into sports, securing exclusive global rights to Major League Soccer (MLS) and a package of MLB games. Apple certainly has the deep pockets to meet F1’s price. If Apple wanted to, it could put F1 races on its Apple TV+ platform (perhaps as a premium add-on, similar to its MLS Season Pass model). One challenge is that F1’s U.S. rights are just one piece of a global puzzle - Apple usually prefers worldwide deals (as with MLS). Still, an Apple bid can’t be ruled out, especially if F1 is willing to bundle in some digital rights or other content (maybe Apple could integrate F1’s own streaming service, F1 TV, into the deal). Let’s not forget the F1 movie that is set to come out this year, which Apple is heavily involved with.

Amazon: Amazon Prime Video streams Thursday Night Football and has dabbled in other sports (like the Premier League in the UK). An F1 package could appeal to Amazon’s desire for year-round, international sports content. Like Apple, Amazon has resources to pay up, but also a reputation for discipline in what it values. Reports suggest Amazon (as well as Warner Bros. Discovery and Fox) have been “lukewarm” about F1’s offering at the current price. Unless F1 lowers expectations or throws in sweeteners (e.g. additional shoulder programming or the aforementioned F1 TV rights), Amazon might pass.

Warner Bros. Discovery (WBD): This would likely mean F1 airing on TNT/TBS or streaming on Max. WBD’s sports focus lately has been on the NBA, NHL, and NCAA, properties it already has. They did launch the Bleacher Report Sports add-on on Max, indicating a toe in streaming sports. But paying $150M for F1, which would be a new acquisition, seems unlikely unless they see a strong business case.

So a few big players have kicked the tires, yet none appear eager to meet F1’s lofty $180M/year ambitions so far. F1’s American owners may have assumed that the sport’s rapid rise in popularity, plus competition between traditional broadcasters and deep-pocketed streamers, would spark a bidding war - but the marketplace reality is more cautious. Research firm Ampere Analysis estimates the “fair” value of F1’s U.S. rights is just over $100 million annually - substantial, but far below Liberty’s target. F1 could be forced to temper its expectations or structure a creative deal (for example, a lower base fee but with advertising revenue-sharing, or a deal that includes promotional commitments to keep building the U.S. fanbase).

U.S. Sports Media Rights in Perspective: F1 vs. the Heavyweights

To understand the scale of F1’s ask, it’s helpful to compare it to other sports media rights deals in the U.S. – from behemoths like NFL and NBA to other motorsports like NASCAR and IndyCar.

F1’s desired $160–180M/year would elevate it above IndyCar by nearly an order of magnitude and well above what NHL hockey commands, but it remains a fraction of major properties like the NFL and NBA. Notably, F1’s ask is also well below what top European football draws in the U.S. (the English Premier League gets ~$450M/year). Still, for a motorsport series, F1’s U.S. rights would be second only to NASCAR’s in value if Liberty Media hits its target.

F1’s U.S. TV deal is only a small slice of F1’s global media rights pie. Liberty Media’s revenue from worldwide broadcasting rights runs in the hundreds of millions annually, with major contracts across Europe, Asia, and beyond. The U.S. has historically lagged behind other markets in both viewership and rights fees - something Liberty is keen to change. The jump from $5M to $90M to potentially $180M in under a decade is dramatic, but Liberty might argue it’s justified as F1 finally “arrives” in America. Skeptics, however, will point out that audience size and cultural footprint still don’t match those fee levels, and U.S. broadcasters will only pay what the market supports.

Converting Hype into Viewership: F1’s Challenge in the U.S.

Despite all the buzz around Formula 1 in the States - glitzy new races, celebrity endorsements, new global sponsors and social media chatter - turning that excitement into consistent viewership is an uphill battle. Several factors are pumping the brakes on F1’s ability to grow its U.S. TV audience in line with Liberty’s aspirations:

Time-Zone Headwinds: The reality is that most F1 races are on the other side of the world relative to U.S. audiences. A typical European GP lights up at 9am Eastern (6am Pacific) on Sunday, while Asian races can be in the middle of the night U.S. time. This isn’t ideal for drawing big live TV numbers. Hardcore fans will wake up early, but the casual viewers may not translate into bleary-eyed live watchers before dawn. Even the much-hyped Las Vegas Grand Prix, added in 2023 specifically for the American market, ended up starting at 1:00am ET (10pm local) to suit F1’s global schedule. That 1am Eastern start was almost unprecedented for a major U.S. sporting event, limiting stateside viewership potential (while giving European fans a convenient prime-time slot). F1 is thus caught in a time-zone tug-of-war: catering to its longtime European base versus maximizing U.S. ratings. The European/global considerations often win out.

From Netflix to Live Action - a Conversion Gap: There’s no question Drive to Survive has massively raised F1’s profile. The docuseries turned drivers like Ricciardo and Verstappen into personalities fans care about, and it sparked interest among demographics that traditionally weren’t motorsport followers. However, converting a Netflix binge-watcher into someone who tunes in every race Sunday and/or pays for teh F1TV app is not guaranteed. Many new fans see F1 through the lens of entertainment and might engage more via highlights, social media, or the Netflix series itself than live broadcasts. F1’s challenge is to make casual fans care enough to watch the real-time competition, not just the scripted, edited version that a streaming show provides.

Competing Sports and Attention Spans: In the crowded U.S. sports landscape, F1 races often clash with other big events. Sunday at 9am ET isn’t head-to-head with the NFL (thankfully), but on fall afternoons the post-race coverage runs into early NFL games, and in spring the races overlap with big college games in other time zones or NBA playoffs later in the day. Even those willing to watch a morning race might not make F1 a habit if their main sports passion takes priority later. Additionally, American viewers have countless options for entertainment; keeping F1 on their radar requires continuous marketing and novelty. Liberty Media has smartly added more races in the U.S. and these races have drawn huge crowds on-site and significant one-off TV audiences. For example, the inaugural Miami GP in 2022 drew about 2.6 million U.S. viewers (a record for F1), showing the potential when timing and hype align. The concern is whether interest dips when the novelty wears off or if a U.S. race isn’t competitive. Sustained growth will require F1 to keep the product compelling and perhaps adjust race timings or scheduling to better suit U.S. fans where possible.

Monetization Beyond TV Ratings: Another wrinkle is that F1’s success isn’t measured purely by Nielsen ratings. Liberty Media touts metrics like social media engagement, F1TV streaming subscriptions, and sponsorship growth. The “fan hype” from Netflix and flashy events is translating into merchandise sales, sold-out U.S. Grand Prix tickets, and more American companies sponsoring F1 teams or races. However, TV rights remain the single biggest lever for revenue, and that requires mass viewership. If F1 becomes a niche streaming-only product in the U.S., it might satisfy core fans but could stunt broader exposure. Thus, Liberty is walking a fine line: it wants to cash in on the excitement (with a rich TV deal) yet must ensure its broadcast partner can deliver larger audiences over the deal’s term, or else the relationship will sour. The next U.S. media partner will need to both promote F1 heavily and perhaps innovate on how races are presented (could we see alternate feeds, dynamic racecasts, or supplementary content to keep new fans hooked?).

Changing How Fans Watch: The Media Puzzle F1 Must Solve

F1 is negotiating this U.S. rights deal amid a shifting media landscape. Cord-cutting has shrunk traditional TV audiences - ESPN has lost over 25% of its subscribers in the past decade. Ironically, F1’s rise in the U.S. was fueled by its wide (and initially free) distribution on ESPN, but relying on cable alone now risks limiting future growth. ESPN’s upcoming move to a direct-to-consumer streaming model underscores that change.

At the same time, streaming is no silver bullet. Platforms like Netflix and Apple have become pickier, wary of sports properties that don’t promise new subscribers. F1’s global appeal fits their brand, but the logistical complexity of live racing, plus an already saturated subscriber base, makes a deal less obvious. Fans, too, are cautious: a move behind a paywall could hurt casual viewership, especially if it means yet another subscription.

Younger fans aren’t necessarily tuning in live, either. Many engage through clips, highlights, and second-screen experiences. That’s pushing broadcasters toward more flexible, multi-platform deals. There’s even talk that F1 might bundle its F1 TV service into the next rights package, offering superfans deeper access while helping the broadcaster keep them within their ecosystem. All of this is happening within this backdrop that we may be losing the very concept of mass media.

This next deal won’t just be about airing races. It will be a layered negotiation involving TV, streaming, and digital content, and likely land somewhere below Liberty’s $180M ask, but well above where things started.

F1’s $180M Question - Growth or Overreach

This U.S. media rights deal will be a litmus test for how much F1’s American momentum is truly worth. Liberty Media is betting big, asking for up to $180 million a year - double the current rate - but broadcasters aren’t rushing to meet that number.

This isn’t just about dollars, it’s about direction. A blockbuster deal would signal F1 is becoming a true heavyweight in the U.S. sports landscape. A more modest agreement, or a reluctant renewal, could mean the sport’s hype hasn’t yet matured into a sustainable media property in America, which I feel is more likely as F1 isn’t yet part of the Zeitgeist the way many other major sports are.

Whatever the outcome, the deal will shape how U.S. fans access and experience F1 - whether it remains easily accessible via ESPN, shifts behind a streaming paywall, or fragments across platforms. One thing is clear: Liberty Media’s U.S. dream is reaching a critical crossroads, and this deal will determine whether it accelerates or stalls.

🔗 Tennis Is ‘Having a Moment.’ Where Are the Legacy Brands? | SportsVerse

In tennis, there’s a crop of young and exciting players coming through on both the men’s and the women’s tours, while new entrant brands like On and Lululemon are disrupting the sport with interesting athlete signings, buzzy activations around major tournaments and compelling apparel and sneaker designs. Read here.

🔗 I’m putting all my chips on Emma Chamberlain becoming a billionaire by 2034

A great thread about how Emma Chamberlain unlocked the Gen Z Attention Formula. Read here.